We will go ahead and assume that women are part of the marketing plan of any financial institution. If they are not, let’s pretend they are for now while you rethink that!

And since they are part of your marketing plan, we will also assume you know that now, more than at any point before, the financial literacy and needs among women are extremely diverse. More women are delaying (or foregoing) marriage and children. More women are solely responsible for financial decisions. And more women are educated, employed and earning high incomes. This is all good news for financial service providers (and women, and the world!). What is not so good news is that financial service providers are still missing the mark when it comes to communicating with women in a way that resonates and motivates.

What are the major trends in women’s financial lives?

She’s The Sole Decision-Maker

The number of unmarried women in the U.S. is rising significantly. This demographic has increased 30% from 2000 through 2017, while the number of married women only rose 12% during the same period. However, connecting with these women comes with nuances, as messaging to never-married women versus those that are divorced or widowed is very different. For instance, messaging to a woman who has never been married can focus on longer term approaches such as saving for retirement or investing for the future. Messaging to a woman who is divorced or widowed may mean that she has traditionally had someone else to lean on or contribute to financial decisions and may need more immediate, short term help.

She Has a Different Attitude Toward Money Than a Man

Men, more than women, view money as a measure of success. Women’s point of view on money tends to be a means of making their lives better for themselves and their families. This sentiment carries over into investing as well. Women tend to want to invest their money with companies that are socially responsible versus simply the ones that will yield the most return. Companies like Ellevest have tapped into this mindset by offering women the opportunity to build a portfolio based on what’s most important to them – putting their personal life priorities at the center of building a portfolio.

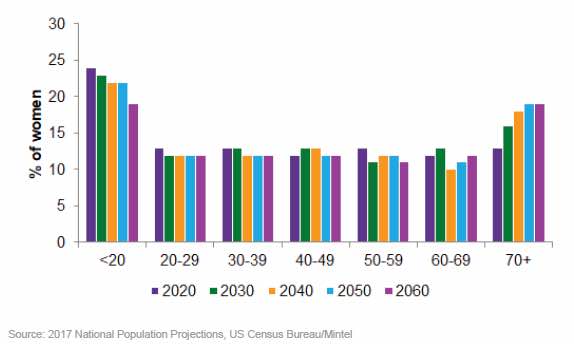

The Opportunities Bookend the Age Groups

This is an especially strange situation for financial service providers. The number of women under 20 and the number of women over 70 are the two age groups expected to grow the most over the next 30+years. On the younger end, reaching women early about retirement plans or investment portfolios that can help them achieve personal goals throughout their adult life is incredibly valuable. On the older end of the spectrum, women over 70 face different financial challenges which can include healthcare costs or vast transfers of wealth from husbands or family members. As stated previously, their needs may be more immediate.

What Strategies are Winning?

Content Tailored For Women

You’re probably saying “well, duh”, but content is really the best medium for reaching women. The challenge to financial brands is to have the variety of content created that address all the circumstances mentioned above. Consider lifestages versus demographics and also consider that financial literacy and confidence varies within the demographic. Does your content partner understand this and are they representing your brands commitment accurately and believably?

Hire More Women To Acquire More Women

The financial services industry is 46% women, there is more of a gender gap at higher positions. According to Forbes, some women in the industry that have reached higher levels report that one of their biggest challenges is achieving the same credibility as their men counterparts. But many women see that as an opportunity to change perception.

According to the same Forbes article, women’s general attitude toward money also extends to those employed in the industry. They want to know the work they are doing is making a difference. Having an empathetic ear when planning finances is a huge opportunity for companies to reach women consumers. Are you already doing that? Are you using your progressive track record in your marketing?

Stronger Together

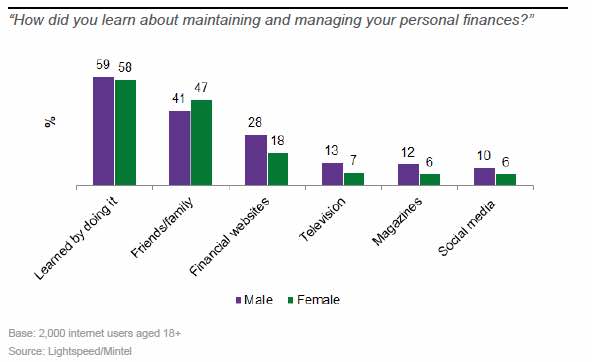

Some brands that need to build their credibility with women have sought out partnerships with organizations that develop educational initiatives tailored to helping women navigate financial planning. It’s so important to remember that most people, men and women, learn by doing (see graph below). So educational programs that provide workshop environments or online practice tools are a great way to educate people. This can range anywhere from engaging local public library systems to top tier universities. This is where strong media partners can really help because those established relationships will help a forge a seamless connection.